pa inheritance tax family exemption

House Bill 465 modified 72 Pa. Pennsylvania imposes an inheritance death tax on assets inherited by children and other non-spouse family members.

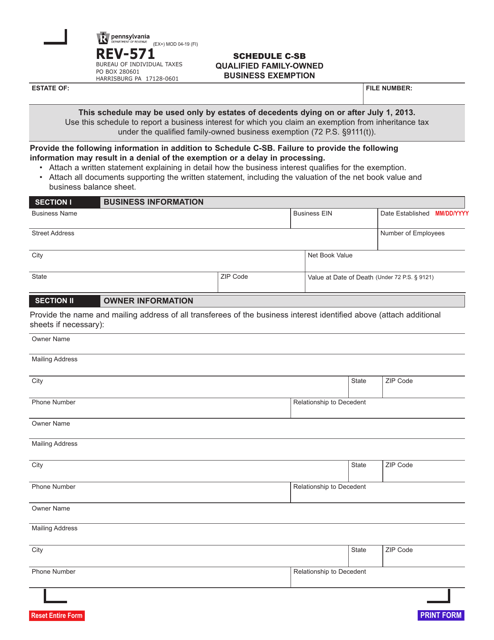

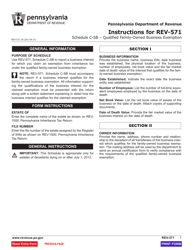

Form Rev 571 Schedule C Sb Download Fillable Pdf Or Fill Online Qualified Family Owned Business Exemption Pennsylvania Templateroller

45 for a lineal descendant or ancestor 12 for a sibling and 15 for other taxable recipients.

. The family owned business tax exemption can have a big impact on your Pennsylvania inheritence taxes. For decedents dying after January 29 1995 the family exemption is 3500. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting from a persons death.

Administration expenses for an estateare fully deductible for Pennsylvania Inheritance Tax purposes. Others such as brothers and sisters grandparents great-grandparents and step-children will become eligible to inherit if a spouse child ren andor parent s is not living. Inheritance Tax Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

That is in the past the exemption didnt apply if the property was owned solely by one of the spouses. On the second anniversary of the granting of real property tax relief under the PA. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

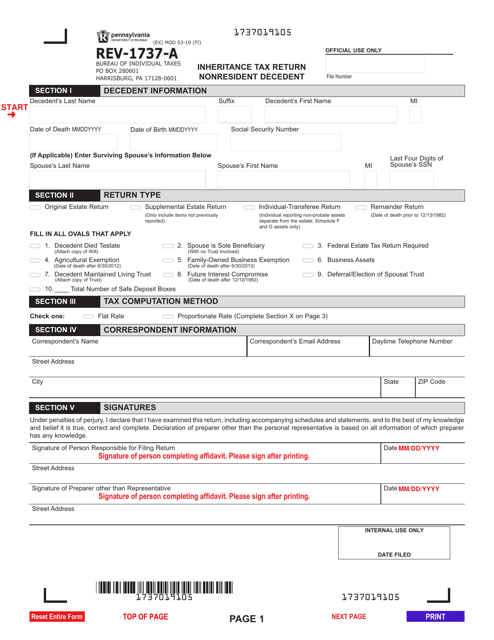

The Pennsylvania Legislature passed House Bill 465 which was signed into law by Governor Corbett on July 9 2013. The Inheritance Tax return is to be filed in duplicate with the county where the decedent was a resident. The amount must be claimed by and paid to a surviving spouse if any or.

The tax rate varies depending on the relationship of the heir to the decedent. Prior to the enactment of Act 85 children who inherited farmland from their parents had to pay a 45 percent inheritance tax on the value of the property transferred. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code.

Pennsylvania also allows a family exemption deduc- tion of 3500 paid to a member of the immediate family living with the decedent at the time of death. For decedents dying after Jan. Historically family owned business owners have been faced with a difficult tax situation at death.

The business can pass to your children but not before paying the 45 Pennsylvania Inheritance Tax. The Pennsylvania inheritance tax is an excise tax on the receipt of inherited property by a beneficiary. Expenses incurred in administering real property held in the decedents name alone are allowed in reasonable amounts.

As long as the farm is being used for agricultural purposes it will be exempt. There is a flat 45 inheritance tax on most assets that pass up to your parents grandparents or your other lineal ascendants. The rate that applies depends on the beneficiarys relationship to the decedent.

For example if a husband owned a bank. Real Estate Tax Exemption Pre-Screening Form. Payment or delivery of exemption.

Family members will have to pay the inheritance tax including interest. In the case of land being left to a decedents sibling for example the tax rate was increased to 12 percent. Last year Pennsylvania eliminated the tax on the inheritance of agricultural real estate by family members provided the property continues to be devoted to agriculture for a period of 7 years.

9111 titled Transfers not subject to tax to include subsection t a new exemption from the Pennsylvania Inheritance Tax for a qualified family owned businesses interest QFOBI provided such interest passes to a. Bucks County Justice Center 100 North Main Street. The tax rate depends on the relationship of the recipient to the decedent ie 0 for a spouse or parent of child under age 21.

The family exemption is 3500. Traditionally the Pennsylvania inheritance tax had a very narrow exemption for transfers between the spouses. Therefore there are limits as to what areas of the farm can be exempt from the inheritance tax.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. If a person has no living heirs the estate will go to the Commonwealth of Pennsylvania. After July 1 2013.

In basic terms assets were exempt from tax only if the spouses owned them jointly. 29 1995 the family exemption is 3500. There is a deduction for the family exemption up to 3500.

The family exemption is allowable against assets which are part of the decedents probate estate. There is a filing fee of 1000 payable to Register of Wills-York County. The rates for Pennsylvania inheritance tax are as follows.

The family exemption is allowable against assets which are passed on with or without a will. 12 percent on transfers to. The Pennsylvania Inheritance Tax is a transfer tax on the transfer of assets from the deceased Pennsylvanian or someone with Pennsylvania real estate to the new owner.

What is the family exemption for inheritance tax. The inheritance tax rates range from 45 to 15. The family exemption cannot be taken against joint assets or other miscellaneous non-probate property.

There are other federal and state tax requirements an executor will need to take care of like. The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust. The tax rate for Pennsylvania Inheritance Tax is 45 percent for transfers to direct descendants lineal heirs 12 percent for transfers to siblings and 15 percent for transfers to other heirs except charitable organizations exempt institutions and government entities which are exempt from tax.

Other Necessary Tax Filings. Federal estatetrust income tax. However it may not be claimed as a deduction on the Federal Estate Tax return as it is considered a terminable interest.

Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the decedent at the time of death. January 21 2013 by Law Offices of Spadea Associates LLC The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or income to take up to 3500 from the decedents bank account until the estate account is opened. Ancestors lineal decedents spouses or estates of any of those persons also qualify.

Payment from real estate. If there are inadequate probate assets to satisfy the family exemption funds can be allocated from an inter-vivos trust to pay the exemption. Where is the inheritance tax return to be filed.

The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents. The family exemption can only be claimed against probate property and will be disallowed as a Pennsylvania Inheritance Tax deduction if there is no probate estate. It does not matter if the transfer is through a Will by beneficiary designation through a revocable living trust or payable on death account.

PERIOD OF USE Act 85 of 2012 focuses on agricultural farming not farming in general.

Pennsylvania Tax Exemption For Family Owned Business

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Form Rev 571 Schedule C Sb Download Fillable Pdf Or Fill Online Qualified Family Owned Business Exemption Pennsylvania Templateroller

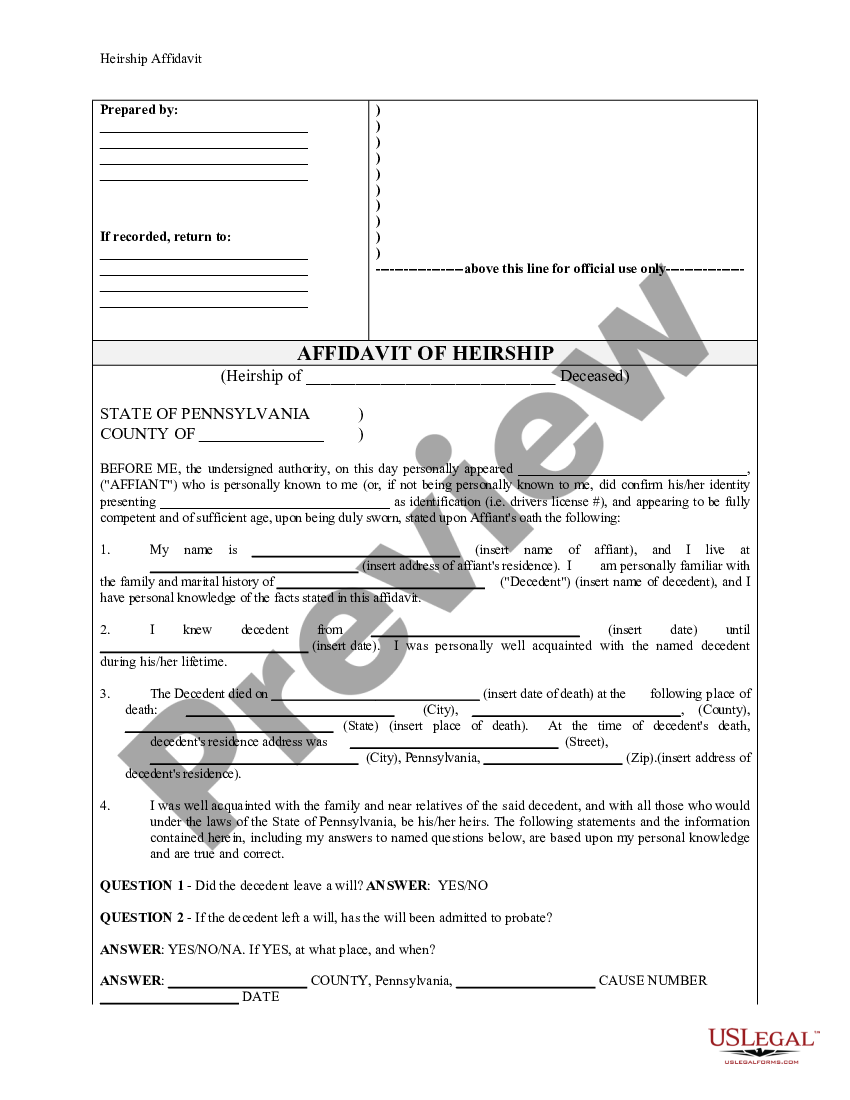

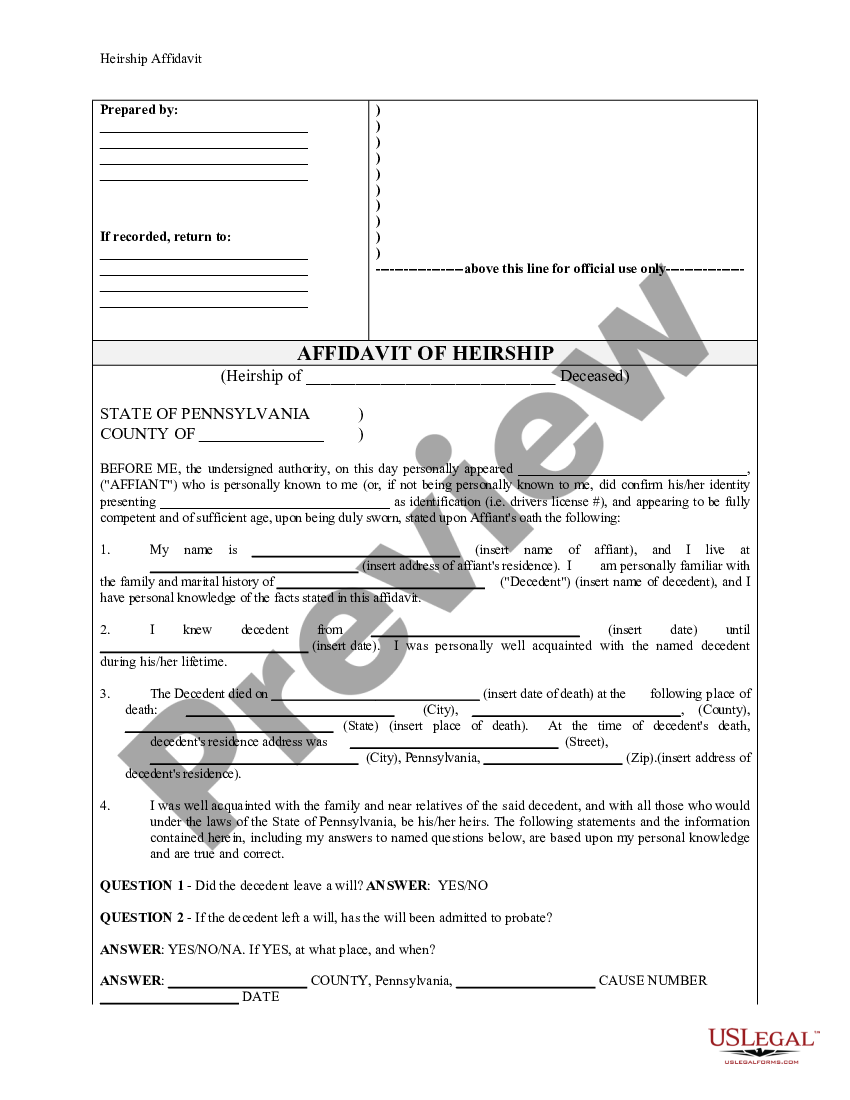

Pennsylvania Heirship Affidavit Descent Affidavit Of Heirship Pennsylvania Us Legal Forms

Inheritance Tax 2022 Casaplorer

Pennsylvania Inheritance Tax Agriculture Family Business Exemptions

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Pennsylvania Orphans Court Lawsource Includes Book Digital Downlo Bisel Publishing

Estate Gift Tax Considerations

Form Rev 571 Schedule C Sb Download Fillable Pdf Or Fill Online Qualified Family Owned Business Exemption Pennsylvania Templateroller

Form Rev 1737 A Download Fillable Pdf Or Fill Online Inheritance Tax Return Nonresident Decedent Pennsylvania Templateroller

How Do State Estate And Inheritance Taxes Work Tax Policy Center